Contents:

Bookkeeping involves recording, tracking, and analyzing financial transactions. But I do understand that it can feel overwhelming to create a budget, keep track of expenses, and figure out how to allocate resources effectively. However, it doesn’t have to be that way if you stay on top of your books. You’ll have all your records organized and ready to go when it’s time to file your income taxes. For example, once I started accurately tracking my income and expenses, I realized that my operating costs were too high compared to my revenue.

- Hiring a bookkeeper is one of the most important hires you will ever make.

- To learn more about how your small business can benefit from our services,schedule your free consultation today.

- For accurate, analytical bookkeeping, call DCA CPAs for more information.

- So there you have it – 7 amazing advantages of bookkeeping that every small business owner should know.

- Virtual Assistants 7 Ways A Bookkeeper Can Save You Money Bookkeeping is crucial, but you don’t have to do it yourself.

- However, while you might be unsure which one you need, most of us need assistance recording and reconciling our daily/weekly/monthly transactions.

By hiring one of our bookkeepers, you can focus on ministering to the people that God has brought through your doors. Whether you’re expanding a new church ministry or planning for a church building, we all know that big dreams come with big price tags. Having a bookkeeper not only helps you maintain accountability but may also help you secure a loan or grant. A good bookkeeper can help you create processes and systems that make your accounting tasks more manageable. Whether you need help with invoicing, payroll or reporting, a bookkeeper can provide the tools and support necessary to complete these tasks quickly and efficiently. This is important if you are looking for ways to streamline your business operations.

In-Depth Knowledge Of Accounting

Historical records indicate bookkeeping existed as early as 6000 B.C. Bookkeepers in Greek and Roman societies counted and noted agricultural crops, as well as payments to farmers. While bookkeeping may have been around for thousands of years, they are just as important now as they were in the ancient past. No representation is made that the quality of the tax services to be performed is greater than the quality of tax services performed by other CPAs or lawyers. Whether a business is small, medium, or large, and no matter what the number of employees or category of business, efficient and accurate bookkeeping can make or break an organization. When you hire a bookkeeper, you are bringing on an expert whose efficiencies and systems will free you up to grow your business and live your life.

You shouldn’t be the one doing it all when it comes to your business. And you definitely can only go so far in handling your own business finances. Growing your business and building lasting relationships with customers. “I was initially confused on the entire process of getting my business up and running in the USA as an Australian. One call with Doola and I signed up straight away. Ask your bookkeeper candidates for references who can testify to the quality of their services.

Bookkeepers Help You Be Prepared

Bookkeepers sometimes use financial calculators for their business, in order to project future income, expenses by the month or by the year. These calculators will help you forecast when you could make changes to your business, such as adding new products or services, or adding new employees. Although QuickBooks has a ton of features to help business owners, bookkeepers with QuickBooks experience are vital for businesses. Along with financial tools, QuickBooks allows bookkeepers to utilize spreadsheets. Spreadsheets have been a part of a bookkeeper’s experience for decades, because they allow bookkeepers to lay out both past and present expenses. If your bookkeeper has QuickBooks experience, he or she will be able to keep your books accurately.

The Daily Breeze: The Weekend Has Arrived – Oil City News

The Daily Breeze: The Weekend Has Arrived.

Posted: Sat, 22 Apr 2023 02:59:51 GMT [source]

Ageras is an international financial marketplace for accounting, bookkeeping and tax preparation services. User reviews of professionals are based solely on objective criteria. A thorough, dedicated bookkeeper will always keep detailed recordsup to date. Bookkeeping is the first step in the accounting process and arguably the most important one.

Improve Your Business Operations

Bookkeepers often work with accountants to ensure that paychecks are appropriately distributed and taxes are paid. A bookkeeper can be an indispensable asset if you own a small enterprise and are looking for assistance handling your finances. A bookkeeper can help you manage your growth by taking on some of the administrative tasks that come with it.

- I teach female solopreneurs how to create & execute strategies, organize & systematize their businesses, and level up their productivity.

- By understanding accounting software & principles, a business owner can avoid costly mistakes and make more informed decisions about the future of their business.

- A bookkeeper can help a business owner make informed financial decisions in the future.

- If you’re self-employed, it can be hard to put a price on your time.

- And finally, one of the best things about bookkeeping is how easy it can make accessing your financial data.

While you may want to do bookkeeping on your own, there’s quite a downside to it. Fewer things will prove as costly as poor money management for your small business. Every small business can benefit from having a bookkeeper on staff or working with a bookkeeping… By hiring a bookkeeping team you can expect the highest quality of work for a fraction of the cost. As a business owner, our team will empower you to plan for the future of your business. Lindsey is a full-time entrepreneur and part-time writer in the personal finance space.

Cash Management Benefits

Whereas a bookkeeper manages basic financial tasks, an accountant is more suitable for a higher level of financial analysis, such as financial forecasts, auditing, and tax preparation. Accountants are more likely to give business owners financial advice and insights. Without the proper training and experience, it’s easy to improperly file federal tax returns, which can prove a costly tax liability for your church. The good news here is that with your 501c3 status, your church is exempt from paying federal income taxes; however, other taxes may apply.

Invoices are one type of financial transaction that bookkeepers regularly handle. An invoice is a listed document of services or products that a company has provided to a customer. It is used to track the amount of money that a company owes to a customer. A bookkeeper can help give you a clear picture of your current financial situation and can help you set realistic future goals. By setting financial goals for your business, you can better handle all aspects of your accounting needs while reaching your financial and professional goals.

Better Relations with Banks and Investors

In this article, we outline eight benefits of hiring a professional bookkeeper for your small business. With accurate bookkeeping, you’ll have valuable information like how your business is performing, if you’re making a profit, which marketing campaigns are successful, and more. Armed with this information, you’ll be able to make informed and timely business decisions.

There’s no need to make appointments to visit your bookkeepers in person. It sorts out everything in balance sheets and income statements, thus enabling you to make informed business finance decisions. These services can thus provide businesses with the support they need to keep on top of their business finances, freeing them up to focus on further growing their business.

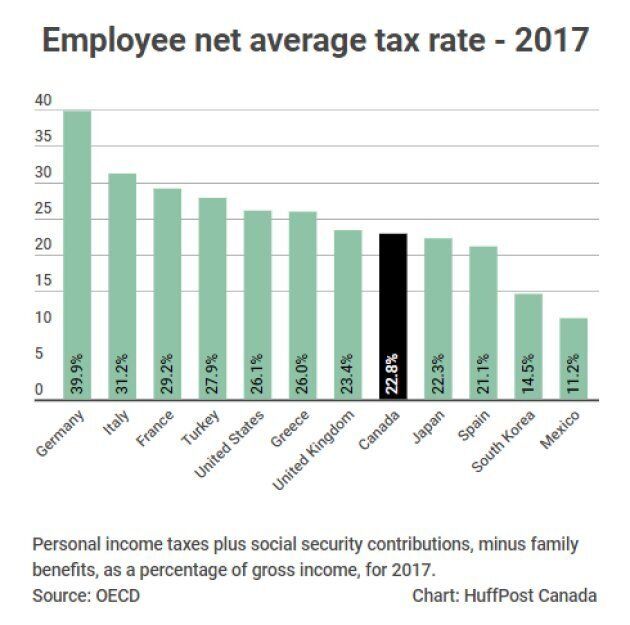

However, it can be what is a deposit slip-consuming if you don’t have someone handling it. Hiring a bookkeeper can free up your time to focus on other tasks and improve your business’s financial stability. A bookkeeper can assist you in keeping track of the deductions and credits you are allowed to take. They also do a strategic tax plan by keeping up-to-date records of your income tax and expenses. This can help you understand how your business will be affected by tax rates and laws.

At StartCHURCH, we understand your time as a minister is precious. We affirm with you that God has called you to lead a ministry, not handle your ministry’s books. At StartCHURCH, our bookkeepers will help you manage your church’s finances.

12 Reasons Why Small Business Owners Should Switch to Digital … – Grit Daily

12 Reasons Why Small Business Owners Should Switch to Digital ….

Posted: Fri, 21 Apr 2023 14:30:00 GMT [source]

No matter what the payroll deduction is, a bookkeeper can keep track of it. A bookkeeper is someone with good accounting skills but may not have a formal degree. They record and classify a company’s daily financial transactions such as sales, expenses, and invoicing. Bookkeepers generally focus less on interpreting data and more on accurate record-keeping. So, to avoid conflict of interest, it is best if you hire an external bookkeeping service for your business as they will guarantee accurate information without an ounce of bias.